Building Your DIY Investment System

In my last post, I discussed DIY investing. As I outlined in that post, I believe you need the following three things to be a successful DIY investor.

- A system for investing

- Time to execute your system

- Discipline to stay with your system

In this post, I am going to discuss several factors to consider when starting to build an investment system and provide a couple examples as starting points.

I view an investment system as your plan of what to buy and sell and when to do so. Having a plan ahead of time greatly increases your chances of success. It can also help you gauge the time commitment and discipline needed.

What to buy?

To determine what to buy you first need to know the following:

- Your investment time horizon

- How much risk to take

Investment Time Horizon

Time horizon is dictated by your goals. If you need your money to be there to spend in one month, you should likely not invest in the stock market. If you don’t need to start withdrawing money until you retire in 30 years, you are able to invest a larger portion of your money into the stock market.

Risk

Risk can be broken down into two components.

- How much risk do you need to take in order to reach your goals?

- How much risk are you comfortable taking in order to sleep well at night and stay with your plan?

The first point above coincides with the fact that, generally speaking, higher risks will gain you higher rewards. If you have large spending goals, you may have to invest in a portfolio with higher risks. However, higher risk also comes with the chance of having larger downside losses. That is where the second point becomes important. You need to know yourself and what you will be willing to live with. If your portfolio experiences losses that are too much for you to handle, chances are good that you may sell at the wrong time or fail to maintain the discipline needed to be successful. There are many ways to gauge the amount of risk you are comfortable with. One way is by taking a risk assessment.

Thinking about time horizon and risk will allow you to make better decisions about how to invest your money.

When to do so?

When should you invest? Early and often. There really is no right answer, but studies have shown that those who invest early, regularly, and in larger amounts will be greatly rewarded in the long run. This allows you to average into the market and allows for the positive effects of compounding interest.

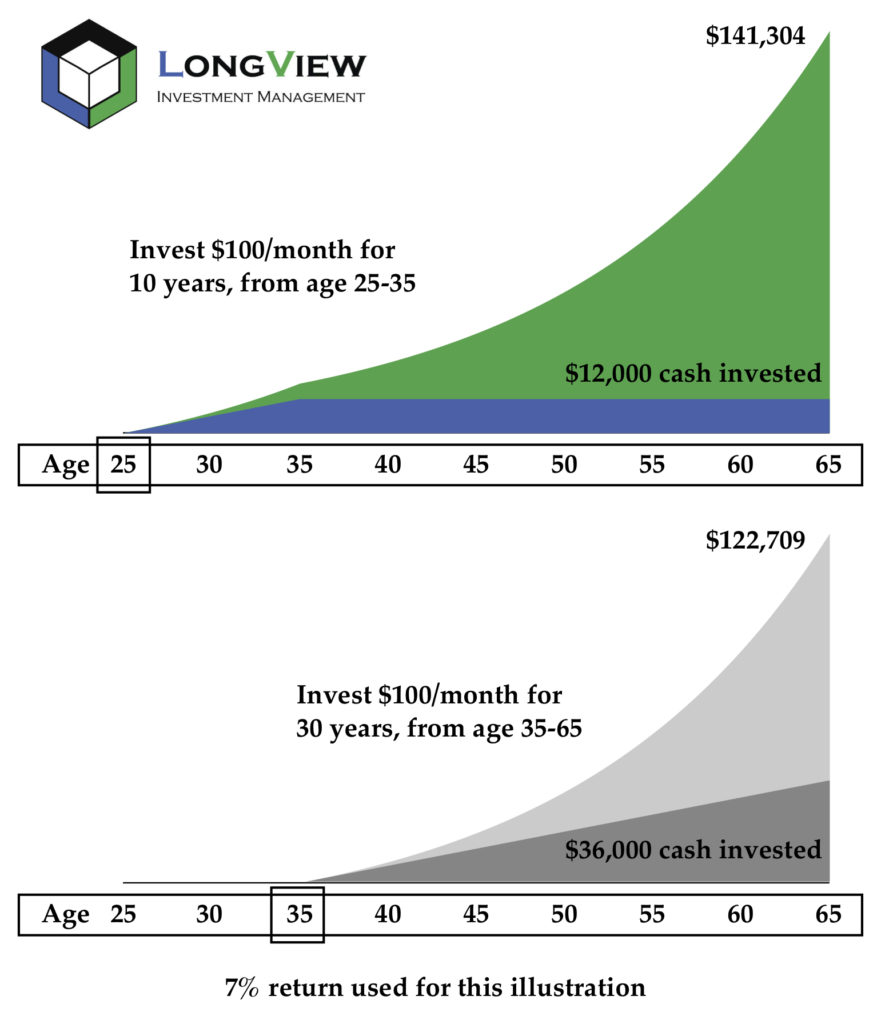

The below charts shows two investors. In the top chart, the investor starts at age 25 and invests $100 per month for 10 years. Then they stop adding money and simply let the portfolio grow. At age 65, their final value is $141,304. The bottom chart shows an investor who waits 10 years to start investing, but then invests $100 per month for the next 30 years. Even with adding $24,000 extra dollars over 20 extra years, the second investor’s portfolio still can’t match the first investor’s final value. The second investor’s final value at 65 is $122,709. Both investors earn the same 7% rate of return in this example. The main difference is starting early. That is compounding interest at work.

Examples

Two popular investment options are the S&P 500 and the 60/40 portfolio. The S&P 500 represents the largest 500 companies in the United States. It is a good proxy for the stock market. The 60/40 portfolio is a mix of 60% stocks and 40% bonds. Both of these options are common benchmarks which professional investors use to judge their performance. Take a look at these as starting points for your investment system. Pay close attention to the return path of each option and how this may correspond with your risk assessment.

In the next post I will be going into more detail starting with these two examples. Please subscribe to follow along.

I hope this helps you to get started building your investment system. If I can help in any way, please let me know at [email protected].

If you found this helpful, please considering sharing with others. Thanks!

Jason